What a Fed Rate Cut Could Mean for Mortgage Rates

The Federal Reserve (the Fed) meets this week, and expectations are high that they’ll cut the Federal Funds Rate. But does that mean mortgage rates will drop? Let’s clear up the confusion.

The Fed Doesn’t Directly Set Mortgage Rates

Right now, all eyes are on the Fed. Most economists expect they'll cut the Federal Funds Rate at their mid-September meeting to try to head off a potential recession.

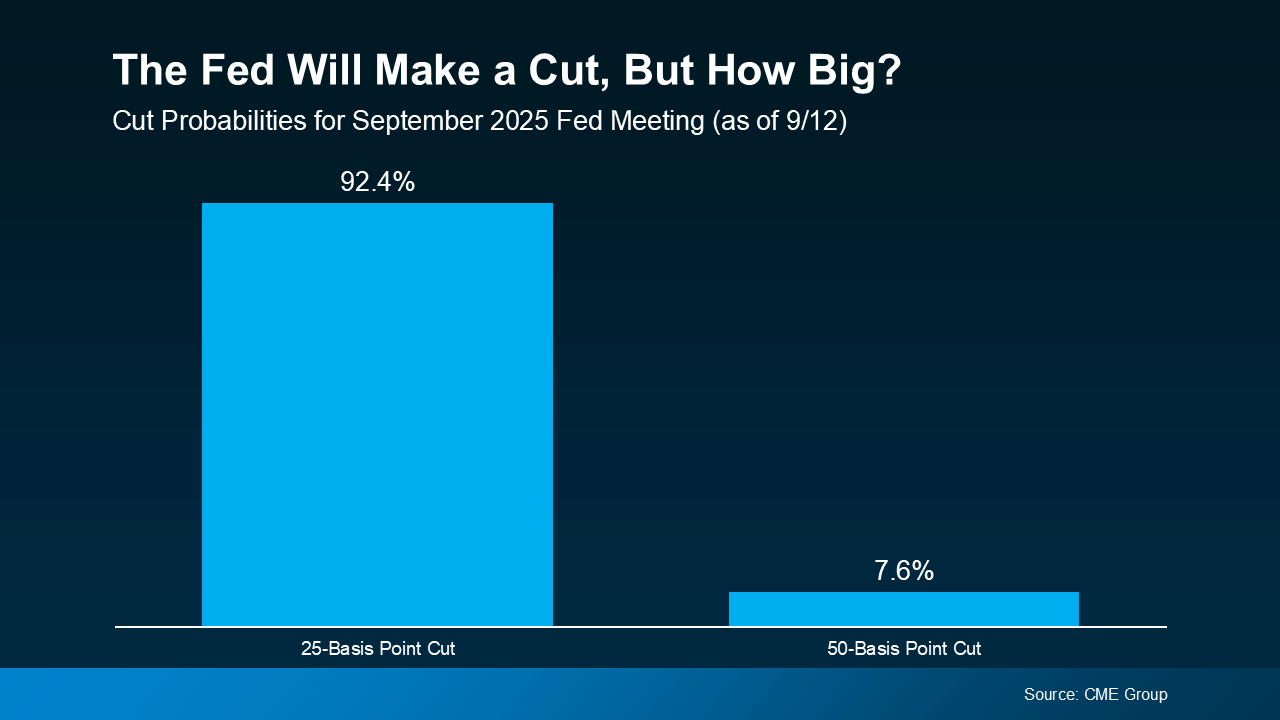

According to the CME FedWatch Tool, markets are already betting on it. There’s virtually a 100% chance of a September cut. And based on what we know now, there’s about a 92% chance it’ll be a small cut (25 basis points) and an 8% chance it will be a bigger cut (50 basis points):

So, what exactly is the Federal Funds Rate? It’s the short-term interest rate banks charge each other. It impacts borrowing costs across the economy, but it’s not the same thing as mortgage rates. Still, the Fed’s actions can shape the direction mortgage rates take next.

Why Markets Already Saw This Cut Coming

Here’s the part that may surprise you. Mortgage rates tend to respond to what the financial markets think the Fed will do, before the Fed officially acts. Basically, when markets anticipate a Fed cut, that outlook gets priced into mortgage rates ahead of time.

That’s exactly what happened after weaker-than-expected jobs reports on August 1 and September 5. Each time, mortgage rates ticked down as financial markets grew more confident a cut was coming soon. And even though inflation rose slightly in the latest CPI report, the Fed is still expected to make a cut.

So, if the Fed goes with a 25-basis point cut, as expected, that’s likely already baked in to current mortgage rates, and we may not see a dramatic drop.

But if they go bigger and drop their Federal Funds Rate by 50 basis points instead, mortgage rates could come down more than they already have.

So, Where Do Mortgage Rates Go from Here?

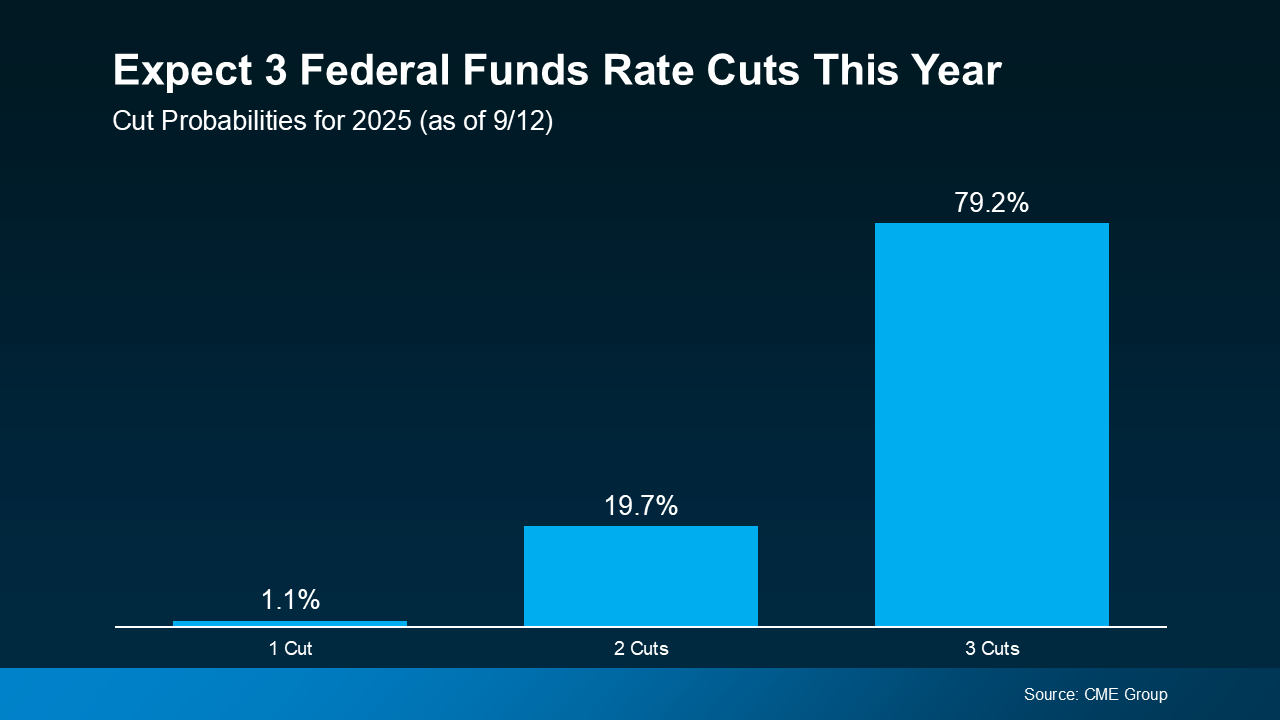

While the upcoming cut may not move the needle much, many experts expect the Fed could cut the Federal Funds Rate more than once before the end of the year. Of course, that’s if the economy continues to cool (see graph below):

As Sam Williamson, Senior Economist at First American, explains:

“For mortgage rates, investor confidence in a forthcoming rate-cutting cycle could help push borrowing costs lower in the back half of 2025, offering some relief to housing affordability and potentially helping to boost buyer demand and overall market activity.”

If multiple rate cuts happen, or even if markets just believe they will, mortgage rates could ease further in the months ahead. But here’s the catch – all of this depends on how the economy evolves. Surprise inflation data or unexpected shifts could quickly change the outlook.

Bottom Line

Mortgage rates likely won’t drop sharply overnight, and they won’t mirror the Fed’s moves one-for-one. But if the Fed begins a rate-cutting cycle, and markets continue to expect it, mortgage rates could trend lower later this year and into 2026.

If you’ve been waiting and watching the housing market, now’s the time to talk strategy. Even small changes in rates can make a meaningful difference in affordability, and understanding what’s ahead helps you make the best decision for your situation.