Patience Won’t Sell Your House. Pricing Will.

Waiting for the perfect buyer to fall in love with your house? In today’s market, that’s usually not what’s holding things up. And here’s why.

Let’s be real. Homes are taking a week longer to sell than they did a year ago. According to Realtor.com:

“Homes are also taking longer to sell. The typical home spent 60 days on the market in August, seven days longer than last year and now above pre-pandemic norms for the second consecutive month. This was the 17th straight month of year-over-year increases in time on market.”

Part of that is because there are more homes on the market. So, with more options for buyers to choose from, they aren’t getting snatched up quite as fast. But there’s another big reason: price.

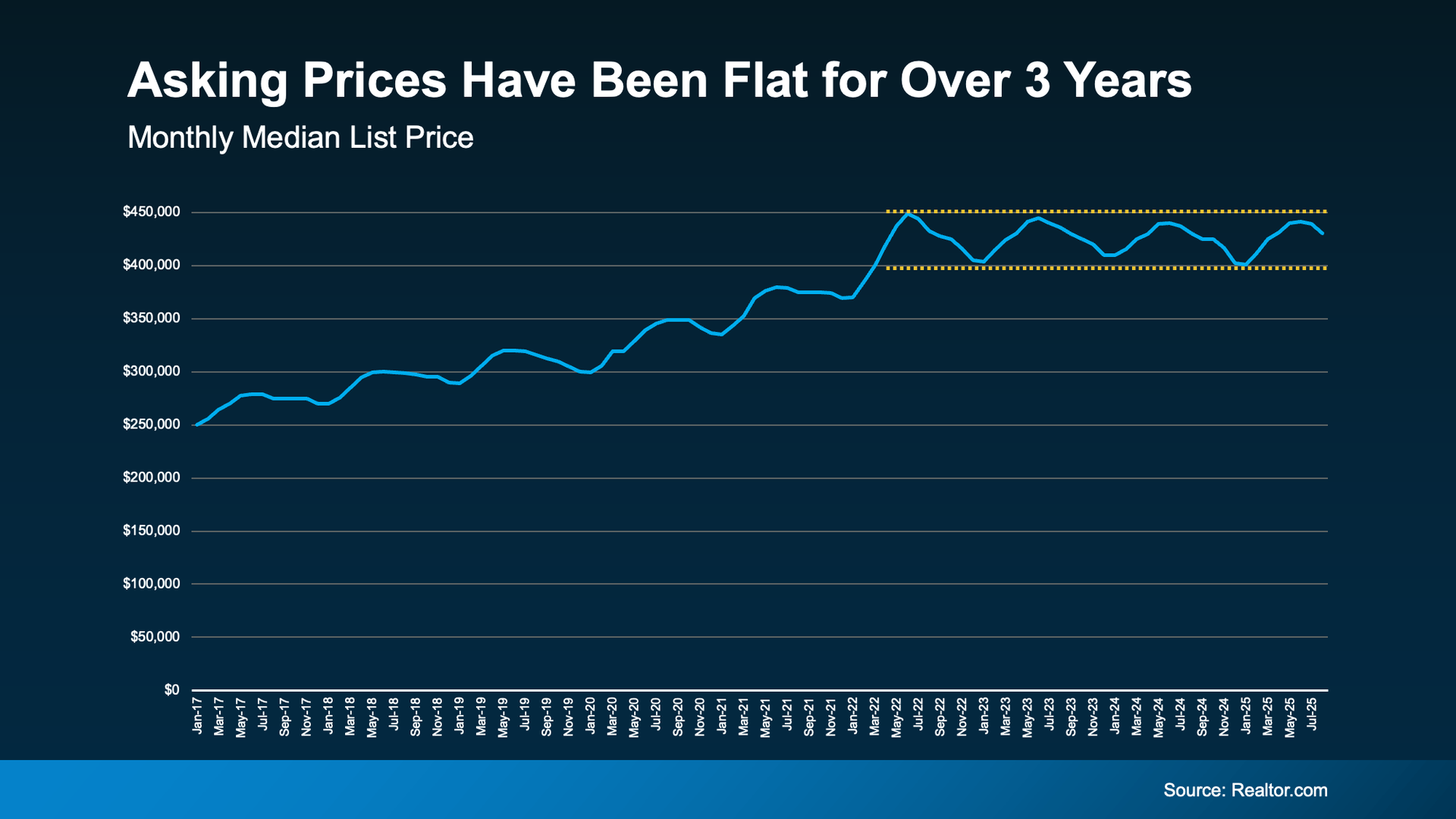

The Average List Price Isn’t Going Up – and That Matters

Today, a lot of homeowners are overshooting their list price. They remember the big climb in home prices a few years ago, and they don’t realize how much has changed.

One of the most important, but often overlooked, changes in today’s housing market is this: average list prices have held steady for the past few years.

That’s a big shift from a typical market, where prices were rising steadily each year. And it’s significantly different than the 2021-2022 surge when sellers could set their price just about anywhere and still attract multiple offers over asking.

But now? That trend has leveled off – and sellers who want to stay competitive need to take note (see graph below):

Here’s what this says about today’s market. Buyers are a lot more price sensitive now. And sellers can’t keep trying to inch the bar higher, or their house will sit without any offers.

Homeowners who expect to bring in more than their neighbors did last year may be setting themselves up for a longer, more frustrating experience.

And while homeowners are starting to realize prices can’t keep climbing at such a rapid pace, the hiccup is that list prices aren’t actually coming down yet as a result. They’re hanging around, holding steady. And sellers who make this mistake are often holding onto hope that they’ll be able to eek a few more dollars out of their sale. But that’s the problem right there.

If you want to sell today, you need to be in line with where the market is today. Not last year. Not during the pandemic. Today.

Because buyers will skip over homes that feel overpriced, even if it’s only by a little. It’s not that they aren’t interested. It’s just that in a market with more homes to choose from, buyers can be more selective, and sellers don’t get the same benefit of the doubt. If your house isn’t priced to sell, buyers just move on. They’ve got other options anyway.

4 Signs Your Price May Be Too High

You may already be feeling this yourself. If your home is listed and you’re not seeing results, watch for these common red flags noted by Bankrate:

- You’re not getting many showings

- You haven’t gotten any offers (or you’ve only gotten lowball offers)

- Buyers that do come to see your house leave overly negative feedback

- Your house has been sitting on the market longer than the average for your area

If any of these sound familiar, know that waiting it out won’t fix it. But adjusting your price will.

So, What’s the Solution?

Work with your agent to make sure your house is positioned for today’s market. Depending on your what’s happening in your local area, a few weeks without traction can raise questions for buyers about whether your price is realistic. And don’t worry – it doesn’t have to be a big drop. Even a small adjustment can be enough to bring the right buyers through the door.

And if you’re worried you won’t get the high-ticket sale price you thought you would be able to land, keep in mind that your equity has probably grown quite a bit. Chances are, you’re still ahead of the game simply because you invested in a home over the last 5, 10, or more years. You’re still winning when you sell today.

Bottom Line

Patience isn’t a strategy. Pricing is.

If your home isn’t moving, the market is telling you something – and the right price can change everything. Your house will sell, if you price it strategically.

Talk to your agent about what buyers are willing to pay right now to make sure your home stands out for all the right reasons.