Welcome to HomeLight

Cash Offer™

California

What is HomeLight Cash Offer?

We make an all-cash offer on your behalf. That has real value. Cash offers are 3x more likely to win and buyers get a 5% savings, on average, versus offers with a loan.*

HERE'S HOW IT WORKS:

- Get approved

- Find your dream home

- Make an all-cash offer

- The offer is accepted

- Take ownership and move in

What our clients and agents say

It’s like HomeLight coming to save the day. My clients have been thrilled with HomeLight. HomeLight Cash Offer made their purchase a reality when they thought it wouldn’t have been possible.

- Kelli Baldwin

HomeLight Cash Offer is maybe one of the most powerful programs because it allows buyers who can’t otherwise compete with cash offers in a competitive market to have the backing of HomeLight. HomeLight will go in and purchase the property, all cash, eight-day close, and then hold onto the property while they finish up the financing with the buyer and then transfer the deed to the buyer through a new transaction. It’s so powerful. I recommend it to everyone, all my clients.

- Sean Proctor

I would definitely recommend this to others, it was a fast, transparent and very efficient process. In a lending market which is currently broken due to COVID19, this is one of the best options for timely closing on a desired property.

- Danny L.

Your HomeLight Cash Offer certification

With early access to HomeLight Cash Offer, you have a distinct advantage over the competition. Our product helps your clients win their dream home and save money in the process. This is because

Cash offers are 3x more likely to win*

Cash offers get a 5% savings, on average, vs offers with a loan

A speedy 8-day close gives you even more negotiating leverage

Need a refresher? Visit the HomeLight Cash Offer Certification Deck.

The HomeLight Cash Offer process

Client gets approved

HomeLight Home Loans application Initial meeting with HomeLight Start home shopping

We make an all-cash offer on your client’s behalf

Your client finds their new home Property information submitted Property approved HomeLight Cash Offer Agreement signed

Offer created

Offer submitted

HomeLight buys the home with cash

Offer accepted Purchase option signed

Deposit made Inspection report ordered and disclosures reviewed

HomeLight closes on your client’s behalf

HomeLight sells the home to your client

Purchase option exercised

Escrow opened

Deposit additional funds needed to close

Loan closes, title transferred

Client gets approved

• HomeLight Home Loans application

Your client is interested in HomeLight Cash Offer and they apply to HomeLight Home Loans to verify their eligibility.

• Initial meeting with HomeLight

Your client meets with a HomeLight Client Manager to discuss their home buying goals and timeline.

• Initial meeting with HomeLight

Your client meets with a HomeLight Client Manager to discuss their home buying goals and timeline.

HomeLight buys the home with cash

• Offer accepted

Our cash offer is accepted and escrow is opened between HomeLight and the seller.

• Purchase option signed

Now that your client’s offer has been accepted, they sign a purchase option for their purchase of the property from HomeLight. This includes the HomeLight Cash Offer fee of 1%, and the fact that they’ll receive a credit for their 5% deposit made to escrow for HomeLight’s purchase. This also specifies that HomeLight will be reimbursed for any ownership costs (including city-specific transfer taxes and property taxes) HomeLight incurs.

• Deposit made

Your client deposits 5% of the purchase price into escrow for HomeLight’s purchase of the property, this acts as their earnest money deposit for the transaction.

• Inspection report ordered and disclosures reviewed

If an inspection contingency was not waived, the inspection is ordered, and we review the inspection report and all seller disclosures with your client. Once we review the report, any buyer credits or required repairs are settled with the seller. We will then have your client sign our HomeLight Cash Offer inspection approval agreement.

• HomeLight closes on your client’s behalf

Escrow closes on the home and title transfers from the seller to HomeLight.

We make an all-cash offer on your client’s behalf

• Your client finds their new home

Once you and your client have found the perfect home and would like to make a HomeLight Cash Offer, we get started on approving the property.

• Property information submitted

You and your client send us the property address and your anticipated offer amount. If your client wants to make an offer not contingent on a property inspection, send us the full disclosure packet including all property inspections.

• Property approved

We approve the property for HomeLight Cash Offer and determine the maximum offer price.

• HomeLight Cash Offer Agreement signed

Your client signs the Cash Offer Agreement, which includes the maximum offer price, the requirement of a 5% deposit for HomeLight’s purchase, and the Cash Offer fee of 1% of the purchase price.

• Offer created

We work with you to create a purchase agreement with you representing HomeLight as the buyer.

• Offer submitted

You submit the purchase agreement to the seller with proof of funds from HomeLight and a letter that explains how HomeLight Cash Offer works.

HomeLight sells the home to your client

• Purchase option exercised

Your client exercises the purchase option and the corresponding residential purchase agreement for their purchase of the property is given to escrow.

• Escrow opened

Escrow is opened between HomeLight and your client. In this transaction HomeLight represents itself as the seller, and you represent your client as the buyer. Their initial 5% deposit is applied to their purchase of the property.

• Deposit additional funds needed to close

Your client works with their HomeLight Home Loans mortgage advisor to determine the additional funds needed for their down payment and closing costs and deposit it into escrow.

• Loan closes, title transferred

Your client’s loan closes and the title is transferred from HomeLight to them. They now own their new home and can move in!

The HomeLight Cash Offer process

What are the associated fees?

We charge a fee to use our funds to make an all-cash offer and purchase the home on your behalf. The fee is dependent on your market, the lender you use, and the number of days we own your home. All fees are calculated off of the home purchase price. Additional costs may apply based on local tax laws.

Fee schedule:

| First 30 days HomeLight owns the home | Every 30 days thereafter | |

|---|---|---|

| When using HomeLight Home Loans | 1.0% | 0.5% prorated by day |

| When using another lender | 3.0% | 0.5% prorated by day |

When your client uses HomeLight Home Loans on their new purchase, the HomeLight Cash Offer fee is 1.5% of the home purchase price plus 0.5% every 30 days thereafter. If they use another mortgage lender, the fee is 3% of the purchase price. Contact cashoffer@homelight.com for more details.

We require a minimum 5% deposit on all HomeLight Cash Offer purchases. This is comprised of:

This deposit is applied directly to your client’s down payment when they purchase the property from HomeLight. Think of this deposit as your client’s “skin in the game” for HomeLight to purchase the property on your client’s behalf.

Client and property eligibility

HomeLight Cash Offer is available to those who fit the following criteria:

• Credit score of 620 or above

• Jumbo loans: 20% down, plus reserves

• Conforming loans: 5% down

• A max debt-to-income (DTI) ratio of 43% for jumbo and 49.9% for conforming

And properties that are one of the following:

• Single-family home

• Townhome • Condo * (subject to property approval)

• Primary or secondary residences

• Are not in pre-foreclosure or short sale

• Do not have major repairs needed to be habitable

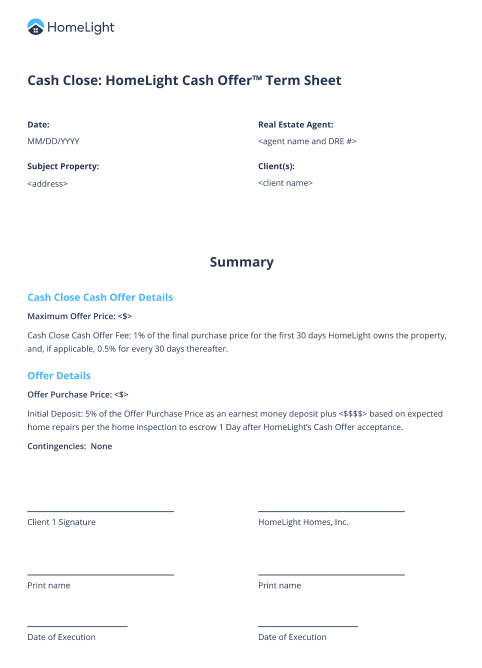

HomeLight Cash Offer agreement example

Once your client confirms that they’d like to proceed with HomeLight Cash Offer, they’ll be required to sign a HomeLight Cash Offer Agreement. This document outlines the terms of the transaction and economic details including offer details, fees, and contingencies

Your business powered by HomeLight

We’ve created marketing tools to help you introduce and explain HomeLight Cash Offer to your clients.

This provides design guidelines and helpful tips on how to best use the Powered by HomeLight marketing materials and logos.

As a HomeLight Cash Offer certified agent, you have a competitive advantage that benefits both you and your clients. You’ll accelerate your commission and you’ll deliver exceptional results that’ll make you a hero for your clients. This kit has everything you need to market this program:

• Product Overview

• Social Media Marketing

• Email Marketing

• Identity guidelines for custom collateral

If you have any suggestions on ways to improve or build upon these materials, drop us an email at brand@homelight.com. You’re on the frontlines and we deeply value your feedback

Agent guidelines and best practices

HomeLight Trade-In and HomeLight Cash Offer are available exclusively to thoroughly vetted and certified agents. We expect our certified agents to represent HomeLight’s best interests during the HomeLight Trade-In and HomeLight Cash Offer processes and uphold our agent and property listing standards. HomeLight will be both your partner and client in these transactions, as you will be selling the property on our behalf. Like any other client, we will be in ongoing communication and expect to be consulted and notified throughout all stages of the process.

The following are the standards to which we hold all certified agent partners.

- You’ll market HomeLight Trade-In and HomeLight Cash Offer to your clients by integrating the products into your listing presentations, buyers consultations, and marketing materials.

2. You’ll facilitate property and deal due diligence. This includes:

- Enabling HomeLight to do a timely home valuation by promptly delivering your CMA for a property and ensuring your client shares photos of the property with your HomeLight Client Manager.

- Reviewing property inspection results with HomeLight to determine what repair work is needed prior to listing the property. For this repair work, you’ll:

- Communicate corresponding cost estimates

- Manage any vendors and/or contractors

- Strongly advocate for the recommended prep work (painting, staging, cleaning, landscaping, etc.) to the client

- Working with your client to create and provide seller disclosures to HomeLight, before HomeLight purchases the home.

3. You’ll list the property within 10 days of HomeLight taking ownership. This means:

- Advocating for the seller to vacate the property as soon as they close on their new property.

- Setting up a lockbox and managing the property to ensure that no one has access to the property aside from your team and approved vendors. Note: Seller may not access the property after HomeLight takes possession, unless HomeLight has given express permission.

4. You’ll execute a best-in-class listing and marketing plan. This includes:

- Coordinating the following work:

- A deep-clean of the property once the sellers have moved out

- Repainting of all interior walls (or touch ups if they’re in great condition)

- Replacement or professional cleaning of any carpets

- Physically staging the home. This is required for all living areas and strongly encouraged for bedrooms. Exceptions can be made depending on the home price point and common practices in your market, but must be discussed with HomeLight.

- Utilizing professional photography and 3D virtual tours for the listing.

- Adhering to HomeLight Move Safe guidelines for any in-person showings.

5. You’ll work with HomeLight as you would any other client. This means:

- Sharing professional photographs once available. In sharing these photographs with us, you also give us the permission to use them in marketing. This includes, but is not limited to, our website, email, and social media.

- Preparing all seller disclosures with HomeLight as the seller, thereby providing the documents upfront for any potential buyers.

- Discussing the listing price and any potential price changes.

- Providing weekly updates on how the property is showing including changes in the market (e.g. price cuts on similar market listings or notable changes in market inventory levels).

- Notifying HomeLight of any offers and discussing potential counter offers. Cross-qualification by HomeLight Home Loans is required to ensure buyers have strong financing before HomeLight’s acceptance of an offer.

- Providing HomeLight a timeline of milestones from opening escrow to closing date once getting into contract with the final buyer.

- Notifying HomeLight of any material updates during escrow including contingency removals.

Refer a client in two simple steps

We will never introduce your clients to another agent. To refer a client:

- Check that your client is likely to qualify. Here’s our quick reference for HomeLight Cash Offer eligibility

- Log into your agent portal and navigate to your Transactions tab in the main header. Select the Cash Offer button, enter your client’s details, and submit.

Our industry experts are here for you. We strive to make buying and selling homes an exciting and satisfying experience for you and your clients. If you have any questions or concerns, you can count on your HomeLight Cash Offer team. We look forward to working with you!

Our office numbers

HomeLight Home Loans

HomeLight Escrow

(858) 935-4590

OFFICE

6085 Douglas Blvd #300

Granite Bay, CA 95746

All Rights Reserved | Jay Friedman Realty Team | Privacy Policy

DRE # 01468010

Real Estate Web Design by Bullsai