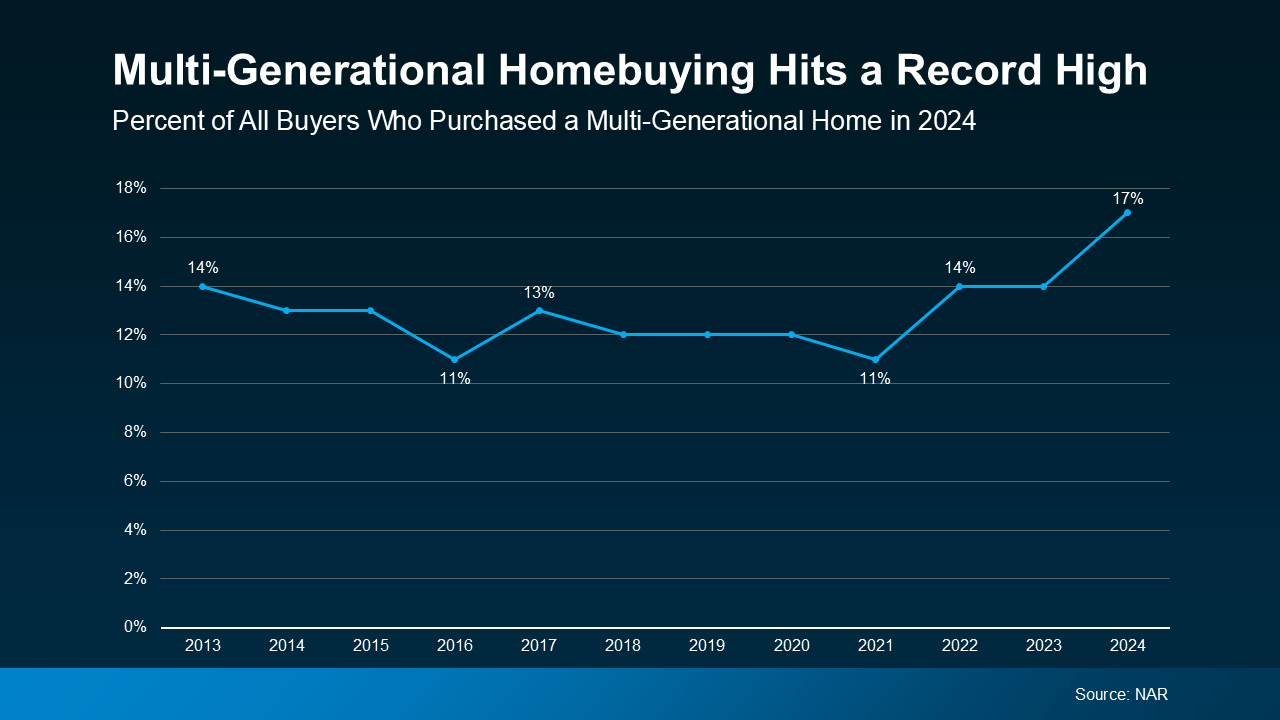

Multi-Generational Homebuying Hit a Record High – Here’s Why

Multi-generational living is on the rise. According to the National Association of Realtors (NAR), 17% of homebuyers purchase a home to share with parents, adult children, or extended family. That’s the highest share ever recorded by NAR (see graph below):

And what’s behind the increase? Affordability. NAR explains:

“In 2024, a notable 36% of homebuyers cited “cost savings” as the primary reason for purchasing a multigenerational home —a significant increase from just 15% in 2015.”

In the past, caregiving was the leading motivator – especially for those looking to support aging parents. And while that’s still important, affordability is now the #1 motivator. And with current market conditions, that’s not really a surprise.

Pooling Resources Can Help Make Homeownership Possible

With today’s home prices and mortgage rates, it can be hard for people to afford a home on their own. That’s why more families are teaming up and pooling their resources.

By combining incomes and sharing expenses like the mortgage, utility bills, and more, multi-generational living offers a way to overcome financial challenges that might otherwise put homeownership out of reach. As Rick Sharga, Founder and CEO at CJ Patrick Company, explains:

“There are a few ways to improve affordability, at least marginally. . . purchase a property with a family member — there are a growing number of multi-generational households across the country today, and affordability is one of the reasons for this.”

But this strategy doesn’t just help with affordability. It may even allow you to get a larger home than you’d qualify for on your own and that gives everyone a bit more breathing room. As Chris Berk, VP of Mortgage Insights at Veterans United, explains:

“Multigenerational homes are more than a trend: They are a meaningful solution for families looking to care for one another while making the most of their homebuying power.”

And momentum may be growing. Nearly 3 in 10 (28%) of homebuyers say they’re planning to purchase a multi-generational home.

Maybe it’s a solution that would make sense for you too. The best way to find out? There are many multi generational options in Roseville, Rocklin, Granite Bay, Folsom and El Dorado Hills… Resale options and new options exist, reach out to me and let’s see if this option would work for you.

Bottom Line

If your budget feels tight, buying a multi-generational home could be a smart solution.

Would you ever consider buying a home with a family member? Why or why not?