Home Projects That Boost Value

Whether you’re planning to move soon or not, it’s smart to be strategic about which home projects you take on. Your time, energy, and money matter – and not all upgrades offer the payoff you might expect. As U.S. News Real Estate explains:

". . . not every home renovation project will increase the resale value of a home. Before you invest in a swimming pool or new addition, you should consider whether the project will pay itself off by getting prospective buyers in the door when it’s time to sell."

That’s why, before you pick up a power tool or call a contractor, your first step should be talking to a local agent.

Planning Ahead Pays Off

If you plan to move relatively soon, you’ll want to get a jump start on your to-do list. And even if moving isn’t on your radar yet, life can change quickly – and a new job, a growing family, or shifting priorities can fast-track your plans. You don’t want to be scrambling to fix up your home if your timeline changes.

Smart updates now = fewer headaches later.

By planning ahead, you can spread out the work over time, which is easier on your wallet and your stress levels. Plus, you’ll get to enjoy the upgrades while you’re still living there and have the peace of mind your house is ready to impress when it's time to list.

What Buyers Want (and What’s Actually Worth Doing)

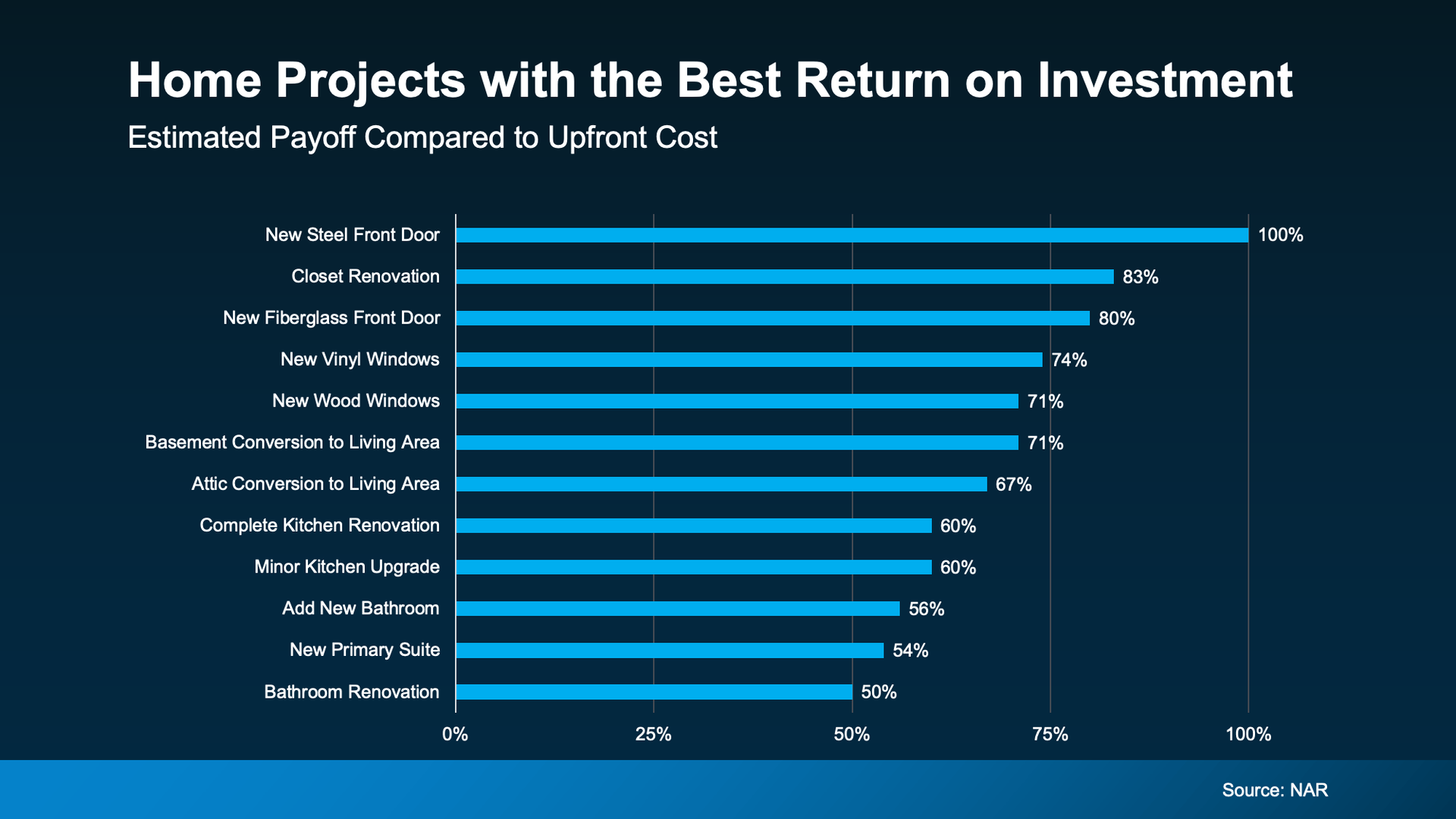

If you’re not sure which projects are worth your time and money – here's some information that can help. A study from the National Association of Realtors (NAR) shows which upgrades typically offer the best return on your investment (ROI) (see graph below):

If an update you're already thinking about overlaps with those high-ROI upgrades, great. Odds are it'll improve your quality of life now and your home’s value later.

But don’t take this list as law. This is based on national data and is the sort of thing that's going to vary based on what’s most sought-after where you live. That’s where your agent comes in. As an article fromRamsey Solutions says:

“The best way to gauge what you can expect in terms of resale value on home improvements—especially if you’re planning to sell soon—is to talk to a real estate agent who is an expert in your market. They’re sure to know the local trends, and they can show you how other homes with the features you want to add are selling. That way, you can make an educated decision before you start ordering lumber and knocking down walls.”

You'll just want to make sure you don't overdo it. Too many high-end updates can make your home the priciest in the neighborhood. That might sound great, but it can actually turn buyers away if it's outside their expected price range for the area. The right agent will help you make smart updates that buyers will love, without going overboard.

Whether the project is big or small, it pays to be strategic. And an agent is a key piece of that strategy.

Bottom Line

It doesn’t matter whether you plan to move soon or not, it can still pay off to make strategic updates that’ll help you love your home now and stand out later.

What’s one upgrade you’ve been thinking about – and wondering if it’s worth it? Let’s make sure it’ll pay off when the time comes.