From Frenzy to Breathing Room: Buyers Finally Have Time Again

If you tried to buy a home a few years ago, you probably still remember the frenzy. Homes were listed one day and gone the next. Sometimes it only took hours. You had to drop everything to go and see the house, and if you hesitated even slightly, someone else swooped in and bought it – sometimes even sight unseen.

That kind of intensity pushed a lot of buyers to the sidelines. It was stressful, chaotic, and for many, really discouraging.

But here’s what you need to know: those days are behind us.

Today’s market is moving slower, in the best possible way. And that’s creating more opportunity for buyers who felt shut out in recent years.

The Stat That Changes Everything

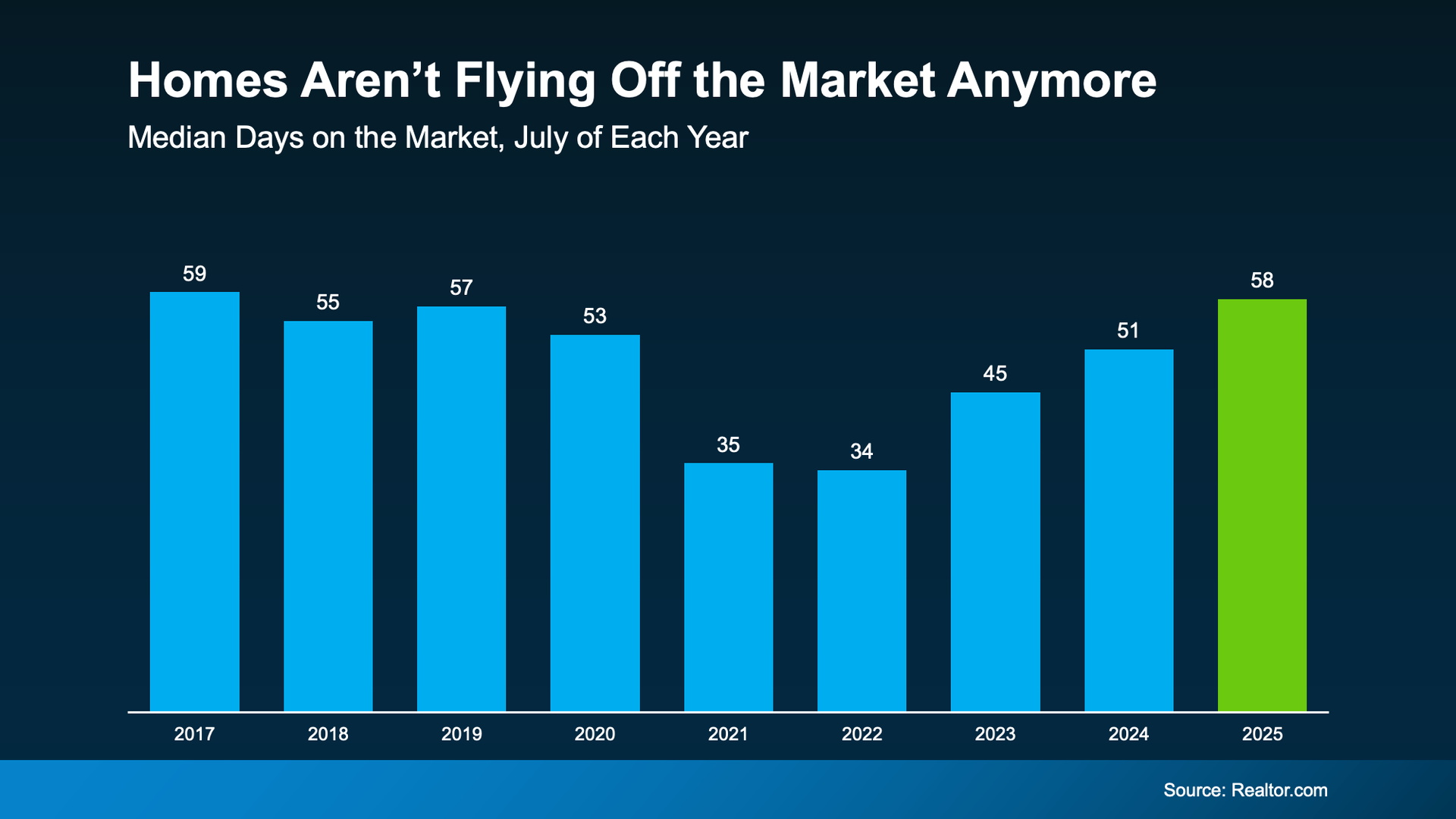

According to the latest data, homes are spending an average of 58 days on the market. That’s much more normal. And it’s a big improvement compared to the height of the pandemic, when homes were flying off the shelves in a matter of days (see graph below):

That means you now have more time to make decisions than you have at any point in the past five years. And that’s a big deal. Now, you’ve got:

Time to think.

Time to negotiate.

Time to make a smart move without all the pressure.

More Time Means Less Stress (and More Leverage)

Based on the data in the graph above, you have an extra week to decide compared to last year. And nearly double the time you would have had at the market’s peak.

Back then, fear of missing out drove buyers to act fast, sometimes too fast. Today, the pace is slower, which means you’re in control. As Bankrate puts it:

“For years, buyers have been racing to snag homes because of the fierce competition. But the market’s cooled off a bit now, and that gives buyers some breathing room. Homes are staying listed longer, so buyers can slow down, weigh their options and make more confident decisions .”

With more homes on the market and fewer buyers racing to grab them, the balance has shifted. Bidding wars aren’t as common, and that means you may have room to negotiate. And you can actually take a breath before you make your decision.

More listings + a slower pace = less stress and more opportunity

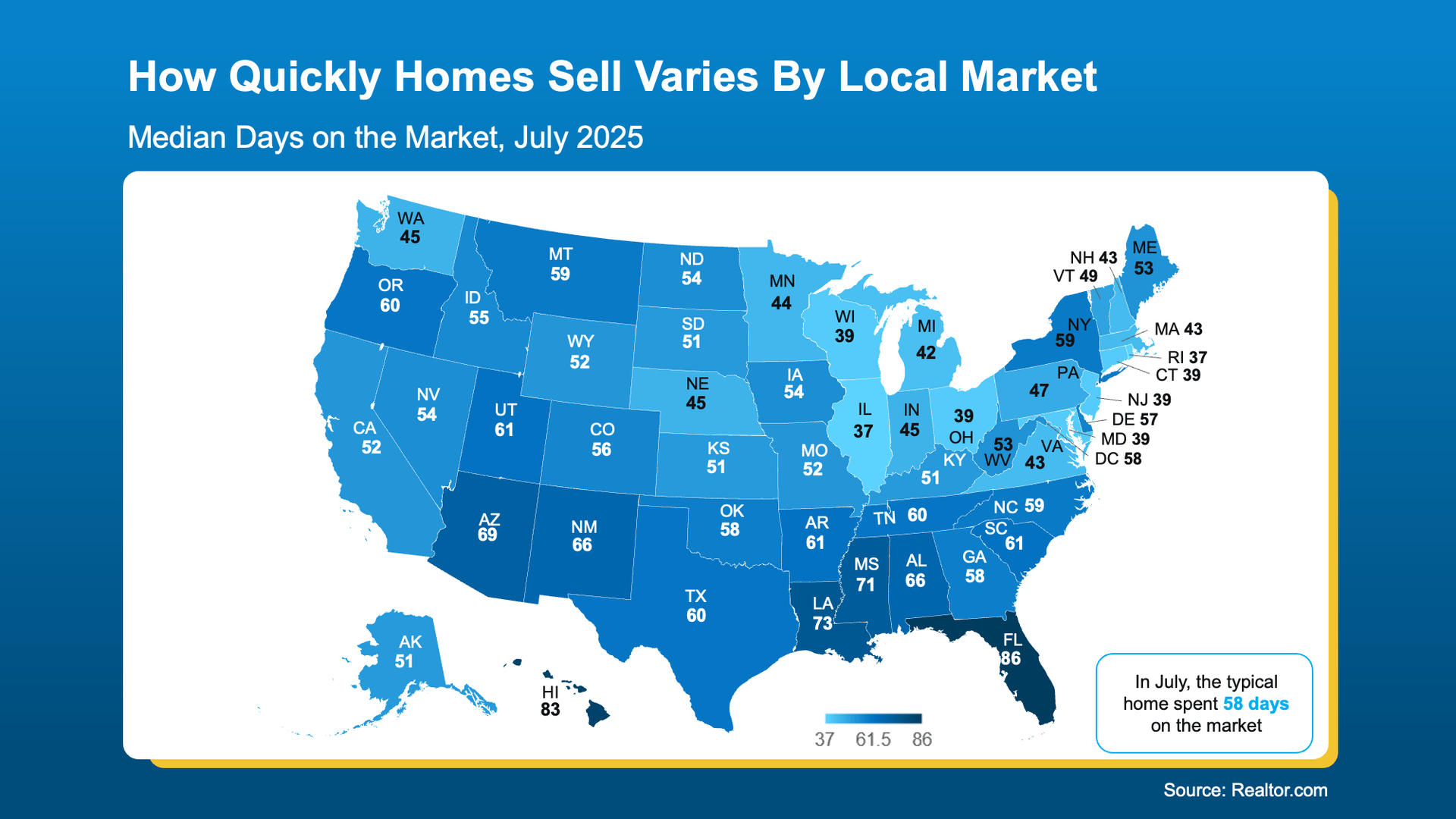

But, and this is important, it still depends on where you’re buying. Nationally, homes are moving slower. But your local market sets your real pace. Some states are moving faster than others. It may even vary down to the specific zip code or neighborhood you’re looking at. And that’s why working with an agent to know what’s happening in your area is more important than ever.

To see how your state compares to the national average (58 days), check out the map below:

As Realtor.com explains:

“ While national headlines might suggest a buyer’s market is taking hold, the reality on the ground depends heavily on where and what you’re trying to buy . Local trends can diverge sharply from national averages, especially when you factor in price range, property type, and post-pandemic market dynamics.”

A smart local agent can tell you exactly when to move fast and when you can take your time, so you never miss the right home for you.

Bottom Line

If the chaos of the past few years drove you to hit pause, this is your green light. The market’s pace has shifted. You have more time. More options. More power.

And with the right agent like me guiding you to buy your new home here in Granite Bay, Roseville, Rocklin El Dorado Hills, or any where in the Sacramento guiding you, you’re in the best position you’ve been in for years. As long as you can afford the payments, you should be an owner. As the market rates come down, and affordability increases so will the buyers, and the competition.

Let’s talk about what the pace looks like in our area, and how now could be the right time for you to re-enter the market too buy your new home.