How Eco-Friendly Features Can Boost Your Home’s Value

Selling your house? Or just looking to increase the value and appeal of your home for when you do? Here’s something you should know – homebuyers are increasingly looking for homes with environmentally friendly features.

What Energy Efficient Features Do Buyers Want?

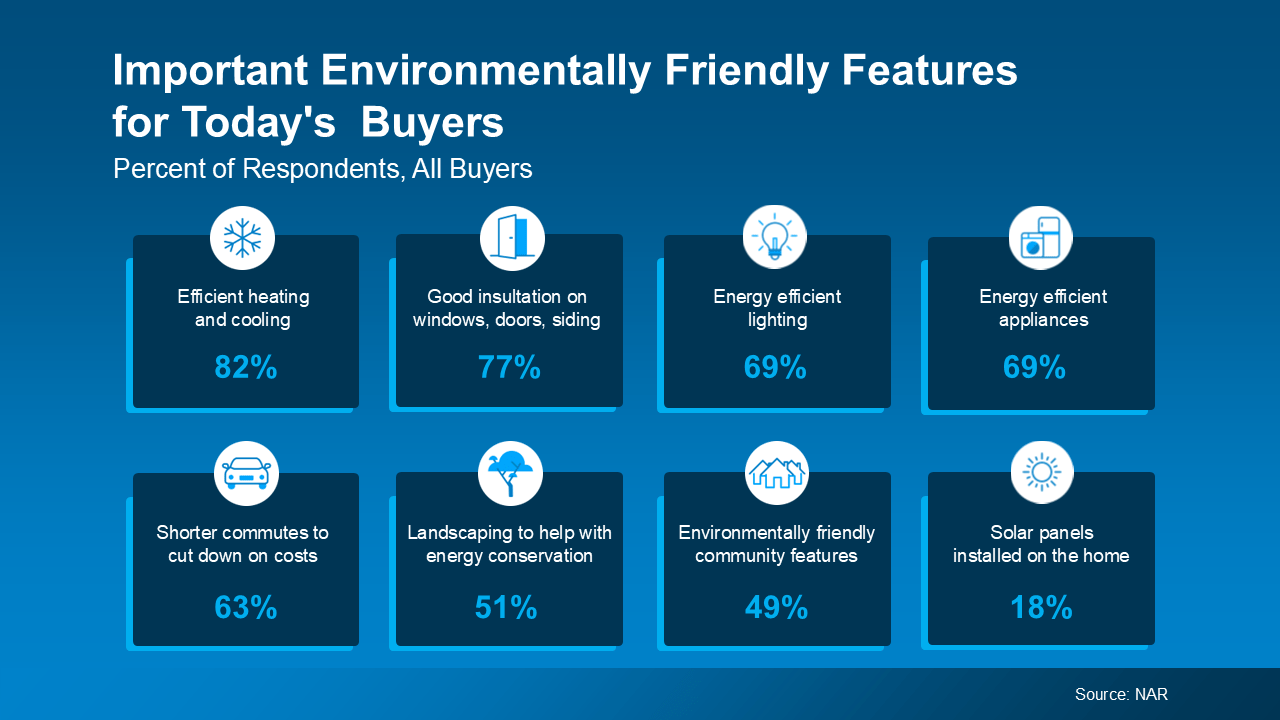

According to recent data from the National Association of Realtors (NAR), when buyers think about eco-friendly features, they’re looking for (see visual below):

- Heating and cooling costs: 82% of buyers consider heating and cooling costs to be one of the most important factors when looking for a home. And efficient heating and cooling systems with programmable thermostats can significantly lower monthly energy bills.

- Windows and doors with proper insulation: These help maintain comfortable indoor temperatures without overworking the HVAC system, which turns into saving on energy bills.

- Energy-efficient lighting and appliances: These can save money on utility bills and reduce a home's overall energy use too.

- Commuting costs and environmentally friendly community features: Living in a community designed with energy-saving amenities and shorter commutes can reduce expenses and environmental impact.

- Landscaping for energy conservation: Strategically placed trees and shrubs can lower cooling costs in the summer.

- Solar panels: Solar panels can also provide long-term savings and are an attractive feature for eco-conscious buyers.

The common theme? Environmentally friendly features are popular with buyers because they help them save money and make homes more comfortable to live in. But making some of these updates before you sell your house doesn’t just benefit buyers – it's worthwhile for you too.

How Green Features Benefit You

If your appliances or systems are aging, upgrading them now means you can enjoy the savings and comfort while you’re still living in the home.

The U.S. Department of Energy has introduced Home Energy Rebates, which can provide households with up to $14,000 in savings on energy-efficient upgrades. This includes insulation, duct sealing, heat pumps, and more. These rebates make it more affordable than ever to improve your home’s efficiency.

Then, when you decide to sell, you’ll reap the rewards again. Energy-efficient homes stand out in a competitive market and appeal to the growing group of environmentally conscious buyers.

Studies also show that homes with energy-efficient upgrades, like those with high-efficiency HVAC systems or modern insulation, are more desirable for buyers- and they generally net a higher price. Research from Freddie Mac found that homes with high energy-efficiency

ratings sold for 2.7% more on average than homes without these upgrades.

Work with a Real Estate Agent to Maximize Value

Not sure which upgrades to prioritize? That’s where I come in to play. I can help you identify the eco-friendly features that buyers in our area value most. Whether it’s adding Energy Star appliances or improving insulation, I will guide you in making the best choices for your house and your budget and I may even have the right vendor I can refer you to for scheduling the improvements your looking to do.

Bottom Line

Making environmentally friendly upgrades can pay off in more ways than one. You can enjoy saving on energy bills and improved comfort now. Additionally, you’ll have the satisfaction of knowing you’re contributing to a more sustainable future while adding value to your home for when we go to selling in the future. Ready to learn more about how you can make your house stand out? Let’s connect.